IN A NUTSHELL: Regardless of the subject or the metric, you are either getting better or getting worse, you can’t be just “holding your own.” IN A NUTSHELL: Regardless of the subject or the metric, you are either getting better or getting worse, you can’t be just “holding your own.” |

“Time Changes Everything.” “Everything Changes Over Time.” Said differently, or more technically, most things which you can measure can be considered as a function of time. This applies to most personal metrics:

- Your weight,

- Your career progression,

- Your achievement of key goals,

- Your net worth,

as well as to most business metrics:

- Your company’s revenue run rate,

- Your company’s profit run rate,

- The yield of a manufacturing process,

- The quality of your company’s products or services, or

- Your customer’s satsifaction with your offerings.

As a leader, when you ask people in your company how well you are doing on a certain key metric, they rarely tell you that things are rapidly getting worse. I’ve found that they also tend to under represent areas where you are doing well. I’ve found that the most common answers you are likely to hear are mediocre answers such as “it’s stable”, “it’s doing OK”, “so-so” or “we’re holding our own.”

As a leader, when you ask people in your company how well you are doing on a certain key metric, they rarely tell you that things are rapidly getting worse. I’ve found that they also tend to under represent areas where you are doing well. I’ve found that the most common answers you are likely to hear are mediocre answers such as “it’s stable”, “it’s doing OK”, “so-so” or “we’re holding our own.”

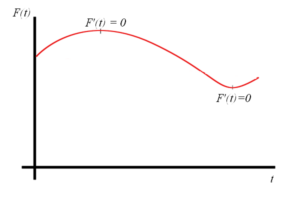

Well, if these answers are similar to the answers you usually get, I have a news flash for you. Your people are LYING to you! Here’s why. To get slightly technical again and take you back to Calc I, the slope of any function F(t) is defined by its first deriviative, F'(t). The only points where the function is not either increasing or decreasing are the local maxima or local minima, the points where F'(t) is equal to zero. Everywhere else, the function is either increasing or decreasing. Do the math!!

So other than for the occasional brief millisecond, your business has to either be constantly getting better or worse. If your people can’t tell you with conviction that things are getting better, chances are they are probably getting worse and you need to get on it!! Challenge those First Derivative assertions!! Keep the velocity positive!!

Jeff,

Your post got me thinking, and while you talk about the first derivative, I'm wondering if it isn't even more important to consider the second derivative when trying to assess the mid- to long-term outlook for an organization (or individual).

The first derivative (slope) is going to largely be set by past decisions; maybe they are set by decisions in the recent past, but in a way it is telling you the impact of what you have “done”.

The second derivative (rate of change of the slope) may be a better indicator of the impact you are making now – are you accelerating change, or are you losing momentum? I would argue, for example, that it may be better in some situations to be in decelerating decline (positive 2nd derivative, negative 1st derivative) than decelerating growth (negative 2nd derivative, positive 1st derivative). In the former you may be starting a turnaround, where in the latter you may be reaching your peak.

This gets a bit abstract, and there are certainly circumstances where an increasing 2nd derivative is just a case of things bottoming out (sales can only go so low, for example). But I think there is value in looking at the impact of “acceleration” versus “velocity”, and to over-focus on the latter may risk missing longer-term trends.

Jeff,

Your post got me thinking, and while you talk about the first derivative, I'm wondering if it isn't even more important to consider the second derivative when trying to assess the mid- to long-term outlook for an organization (or individual).

The first derivative (slope) is going to largely be set by past decisions; maybe they are set by decisions in the recent past, but in a way it is telling you the impact of what you have “done”.

The second derivative (rate of change of the slope) may be a better indicator of the impact you are making now – are you accelerating change, or are you losing momentum? I would argue, for example, that it may be better in some situations to be in decelerating decline (positive 2nd derivative, negative 1st derivative) than decelerating growth (negative 2nd derivative, positive 1st derivative). In the former you may be starting a turnaround, where in the latter you may be reaching your peak.

This gets a bit abstract, and there are certainly circumstances where an increasing 2nd derivative is just a case of things bottoming out (sales can only go so low, for example). But I think there is value in looking at the impact of “acceleration” versus “velocity”, and to over-focus on the latter may risk missing longer-term trends.

Thanks Greg –

I got your meaning / engineer’s abstraction and probably tend to agree. Everyone wants to accelerate change, and I guess implied in my point is the understanding that if your velocity is negative and you want to get it positive, that there is a positive second derivative required as well, eh?